Iran's Year Under Maximum Pressure

Since the Trump administration reimposed secondary sanctions on Iran in November 2018 as part of its “economic war,” the Iranian economy has faced higher inflation, disruption in trade, and a manufacturing slowdown. But over the least year, there are signs of resilience and readjustment that suggest that Iran’s economy is unlikely to be brought “to its knees,” despite the fact that the economy continues to face significant hurdles.

Download Report

January 2020 - 14 Pages

Please enter your email address in order to download the full report.

Executive Summary

Since the Trump administration reimposed secondary sanctions on Iran on November 5, 2018 as part of its campaign of “economic war” on the Islamic Republic, there has been a great deal of speculation as to whether unilateral sanctions would prove sufficient to bring Iran’s economy “to its knees.” One year later, the serious impacts of the Trump administration’s “maximum pressure” policy are impossible to deny. The International Monetary Fund (IMF) projects that Iran’s economy will contract by 9.5 percent this year, the largest contraction since the height of the Iran-Iraq War in 1984. However, there are already signs of readjustment in the Iranian economy. The IMF’s also projects that Iran will return to zero growth in 2020—a rebound that would parallel Iran’s experience in 2012-2013, in which Iran rebounded from a 7.4 percent contraction to minor 0.2 percent contraction the following year.

In the second half of 2019, marked improvements in several areas of Iran’s economy suggest that the country may emerge from its recession in 2020. Foreign exchange markets have largely stabilized, manufacturing activity is expanding, and non-oil sectors of the economy are beginning to generate new jobs. However, significant risks remain. A recent move by the Supreme National Security Council to reduce a long-standing fuel subsidy, which effectively tripled the price of gasoline, triggered widespread protests beginning in the nighttime of November 15. The subsequent violent crackdown, which led to more than 300 deaths and thousands of arrests, no only gave rise to a crisis in state-society relations in Iran, but has also threatened to undo much of the progress in the government’s efforts to stabilize the economy. The Iranian rial lost 10 percent of its value in the weeks following the protests. Events at the outset of 2020, including the airstrike that killed Qods Force commander Qassem Soleimani and the accidental downing of Ukrainian International Airlines Flight 572 by Iranian air defense, have further contributed to political and social instability in Iran, which may have a bearing on economic resiliency moving forward.

Trump administration officials have pointed to the unrest in Iran to argue that their maximum pressure campaign is working, and have warned that Iran’s government is poised to collapse. These prognostications are premature, despite the seriousness of the recent protests and the strain in state-society relations. Macroeconomic indicators point to a considerable ability among Iranian government institutions and economic operators to adapt to the headwinds. This report will present a narrative analysis of the Iranian economy in order to describe both the factors that continue to stave Iran’s economic collapse as well as areas of ongoing vulnerability.

A Provisional Assessment of INSTEX

New analysis by Bourse & Bazaar and the European Leadership Network, evaluates INSTEX's design and operationalization. Drawing on meetings with European officials, business leaders, and legal and financial experts engaged in discussions around the mechanism, the report sets out how INSTEX will operate, and makes clear that it is a limited solution for a specific problem.

Download

June 2019 - 12 Pages

Please enter your email address in order to download the full report.

Executive Summary

By Esfandyar Batmanghelidj and Sahil Shah

This new report from Bourse & Bazaar and the European Leadership Network, the third in a series examining issues around Europe-Iran bilateral trade, evaluates INSTEX's design and operationalization. The report draws on recent meetings with European officials, business leaders, and legal and financial experts engaged in discussions around the mechanism.

France, Germany, and the United Kingdom (E3 governments) will soon announce further steps to operationalise INSTEX. The test for European policymakers is whether INSTEX’s first transactions can take place before July 7th, before Iran’s 60-day deadline. Iranian and European policymakers will then determine whether this forms an effective European response to Iran’s pending escalation on the nuclear aspects of the JCPOA.

INSTEX is a limited solution for a specific problem. The mechanism is intended to alleviate restrictions on sanctions-exempt trade, stemming from the reluctance of European banks to conduct cross-border transactions with Iran.

INSTEX cannot directly counteract the Trump administration’s “maximum pressure” campaign nor can it fully deliver on the JCPOA’s economic promises. Given its focus on humanitarian trade, INSTEX can help Iranian people by reducing the inflationary impact of increases in the price of imported goods.

The strength of INSTEX is in its declared humanitarian focus, which shields it from US pressure and also maximizes the likelihood that European companies will engage the currently untested mechanism. The officials working to operationalize INSTEX are doing so in accordance with four workstreams:

Workstream 1: Operations and Trade Mechanism

Workstream 2: Compliance Framework

Workstream 3: Integration with Iranian Corresponding Entity

Workstream 4: Expansion to “Like-Minded Countries”

Progress is being made in each workstream. However, significant challenges remain that will likely mean that in 2019 the scale of INSTEX commercial operations will be limited. The critical question facing policymakers in Europe and Iran is whether the first transactions can take place in the next few weeks in order to be part of Europe’s considered response to Iran’s escalation on the JCPOA.

New Dynamics in China-Iran Trade Under Sanctions

A review of trade data from the General Customs Administration of the People’s Republic of China shows that China-Iran trade has fallen dramatically in the two months following the reimposition of US secondary sanctions. Chinese exports to Iran have collapsed from about USD 1.2 billion in October 2018 to just USD 391 million in December 2018—a fall of nearly 70 percent.

Download Report

January 2019 - 12 Pages

Please enter your email address in order to download the full report.

Executive Summary

A review of trade data from the General Customs Administration of the People’s Republic of China shows that China-Iran trade has fallen dramatically in the two months following the reimposition of US secondary sanctions. Chinese exports to Iran have collapsed from about USD 1.2 billion in October 2018 to just USD 391 million in December 2018—a fall of nearly 70 percent.

Looking to trade data and recent developments, this paper suggests that China may be abandoning the policy of sustaining trade with Iran in direct contravention of US sanctions, introducing both economic risks in regards to Iran’s continued industrialization and political risks in regards to Iran’s continued compliance with the JCPOA.

If China remains unwilling or unable to sustain trade ties with Iran in the face of US sanctions, the consequences in Iran will prove significant. While pressures were expected in Europe-Iran trade, the addition of pressures stemming from China will further weaken Iran’s economy. The slowdown in exports of food, medicine, and consumer goods from Europe will contribute to inflation, while the slowdown in exports of machinery and equipment from China will lead to decreasing production and layoffs in the manufacturing sector. A recent survey of members conducted by the Tehran Chamber of Commerce identified that 72 percent of enterprises expect to business conditions will worsen for their firm over the coming year.

To the extent a change in policy in Beijing will contribute to layoffs across Iran in the coming months, the trajectory of China-Iran trade may prove more consequential than Europe-Iran trade for Iran’s ability to remain in the JCPOA.

A Humanitarian Special Purpose Vehicle

Drawing from discussions held at the 5th Europe-Iran Forum on May 14 in Paris, France, this report argues that in creating a special purpose vehicle for Iran trade, Europe should constrain the initial focus of the entity on humanitarian goods, creating a humanitarian special purpose vehicle or H-SPV. In doing so, Europe can be more ambitious in the mechanism used by the H-SPV to facilitate Europe-Iran trade and investment in the face of U.S. secondary sanctions. The report is a joint publication of the European Leadership Network and Bourse & Bazaar.

Download

November 2018 - 16 Pages

Please enter your email address in order to download the full report.

Executive Summary

By Esfandyar Batmanghelidj and Axel Hellman

The US withdrawal from the Joint Comprehensive Plan of Action (JCPOA) and ensuing “maximum pressure” campaign against Iran has led to a diplomatic clash with the European Union and a quorum of its member states who are striving to protect the nuclear deal. At this point, competing US and European interests and policy initiatives have not only created friction over the JCPOA and Iran policy writ large, but also driven a wedge in transatlantic cooperation in a crucial theater for both European and US security policy.

There is, however, one issue on which US and European officials seem to be in agreement: that the Iranian people should be spared from the hardships of economic sanctions. Senior officials in the Trump administration have consistently emphasized that US sanctions are targeted against Iran’s leadership and not its ordinary citizens. If genuine, such statements point to one potential area of cooperation between Europe and the United States: ensuring that humanitarian trade can persist even under stringent US sanctions on Iran.

This new report by Esfandyar Batmanghelidj and Axel Hellman argues that the establishment of an humanitarian special purpose vehicle, or H-SPV, could help Europe achieve several goals:

First, it would allow Europe to demonstrate its ability to sustain vital trade with Iran in the face of US sanctions. The H-SPV can be brought online faster, more reliably, and with a clearer direct impact on the wellbeing of the Iranian people than a general SPV.

Second and related, the H-SPV would advance European economic sovereignty.

Third, the H-SPV would serve as a test to the US commitment to protect humanitarian trade. If the US accepts to join the H-SPV, Europe will have effectively neutralized the issue of compliance fears that might linger around any Iran-specific mechanism. If the US refuses, Europe will be further justified in pressuring US authorities for licenses and other measures that will provide comfort to its banks regarding the SPV.

Fourth, the H-SPV could prove innovative for sanctions policy. The experience of establishing multilateral mechanisms to sustain humanitarian trade will be invaluable in a world where the imposition of unilateral sanctions looks increasingly likely.

To achieve these goals, the H-SPV should be established in accordance with these criteria:

It should focus exclusively on humanitarian trade.

The focus on humanitarian trade would enable a functional linkage of the H-SPV to European banks, including European central banks. In this role it could serve as a kind of trading house, able to serve as an intermediary on behalf of European and Iranian companies.

While an SPV focused on trade considered sanctionable by the US is unlikely to develop far beyond the netting service currently envisioned, the H-SPV could develop into a “gateway bank” which serves as an intermediary between the Iranian and European financial systems.

While the H-SPV would be foremost intended to serve European companies, the mechanism could be opened to other trading partners, such as China and India. Europe should also invite the United States to participate in recognition of a shared commitment to ensure that the Iranian people are not unduly harmed by sanctions.

The findings of this paper are informed by discussions held at Bourse & Bazaar's 5th Europe-Iran Forum, held on November 14 in Paris, France.

A New Banking Architecture in Response to US Sanctions

Drawing from discussions held at the Iran Financial Future Summit on May 29, this report outlines a "new banking architecture" to facilitate Europe-Iran trade and investment in the face of U.S. secondary sanctions. At the center of this architecture is the creation of an "EU-OFAC," a regulatory body that would support measures in compliance and legal protection. The report is a joint publication of the European Leadership Network and Bourse & Bazaar.

Download

June 2018 - 24 Pages

Please enter your email address in order to download the full report.

Executive Summary

By Esfandyar Batmanghelidj and Axel Hellman

On May 8, U.S. President Donald Trump announced that the United States would unilaterally withdraw from the 2015 international nuclear agreement with Iran, known as the Joint Comprehensive Plan of Action (JCPOA). The Trump administration is now set to pursue a “maximum pressure” campaign against Tehran. As part of this approach, all U.S. sanctions lifted pursuant to the JCPOA will be re-introduced, the few licenses enabling certain exemptions to U.S. sanctions will be revoked, and “additional economic penalties” will be devised.

From the Iranian perspective, the return of U.S. sanctions means a lost opportunity for growth and international engagement, but not an impending economic catastrophe. From a European perspective, sustaining economic exchange with Iran is not about advancing economic gains but rather about consolidating an agreement which is driven by pragmatic security concerns. The shared elements are clear—Iranian and European policymakers alike are foremost motivated by a need to salvage the JCPOA and thereby protect their economic sovereignty and autonomy in international relations.

To support these ends, this paper presents a vision of a new banking architecture that must be at the heart of Europe’s package to protect Europe-Iran economic ties. This banking architecture should be designed not to evade US sanctions, but to ensure that those companies that can operate in compliance with U.S. secondary sanctions have access to the necessary banking services.

The design of this architecture should be presented to Tehran not as a “turnkey” initiative that can simply be switched on, but rather as a part of a comprehensive “roadmap” for joint European and Iranian implementation, in pursuit of expanded economic relations.

The architecture should have two main elements:

It should be centered on “gateway banks”—financial institutions which can serve as intermediaries between major Iranian and European commercial banks.

It should be overseen by an “EU-OFAC,” a regulatory authority modeled on the U.S. Treasury Office of Foreign Assets Control, but with a philosophy of operation geared towards facilitation of trade rather than restriction.

EU-OFAC would pursue measures in two domains:

Compliance:

EU-OFAC would develop common standards, tools, and certification mechanisms for due diligence to enable European businesses and banks to have greater confidence about the compliance of their activities, thus addressing a longstanding issue with the interpretive guidance issued by the United States.

Drawing on a successful model developed in Germany, EU-OFAC would supportcollaborative efforts to increase the reliance on and reduce the costs of duediligence among the gateway banks.

EU-OFAC would also assist European companies in seeking waivers and exemptions from U.S. authorities and act as an interlocutor between European companies andU.S. authorities.

Legal Protection:

EU-OFAC would strengthen EU legal protections for entities engaged in Iran trade and investment by developing guidelines related to a strengthened blocking regulation, creating linkages to laws that underpin the Single European PaymentsArea (SEPA) and to non-discrimination in the provision of banking services.

The findings of this paper are informed by discussions held at Bourse & Bazaar's Iran Financial Future Summit on May 29, 2018 in Brussels, Belgium.

The Economic Implementation of the JCPOA

Following President Trump's decision to reissue key sanctions waivers and keep the United States in the Iran Deal for the time being, Bourse & Bazaar is launching a special report on the two year anniversary of the implementation of the JCPOA. This report draws on a new survey designed and implemented in collaboration with International Crisis Group. The survey includes detailed insights from over 60 multinational senior executives working in Iran. The survey was administered in December 2017.

Download Report

January 2018 - 22 Pages

Please enter your email address in order to download the full report.

Key Findings

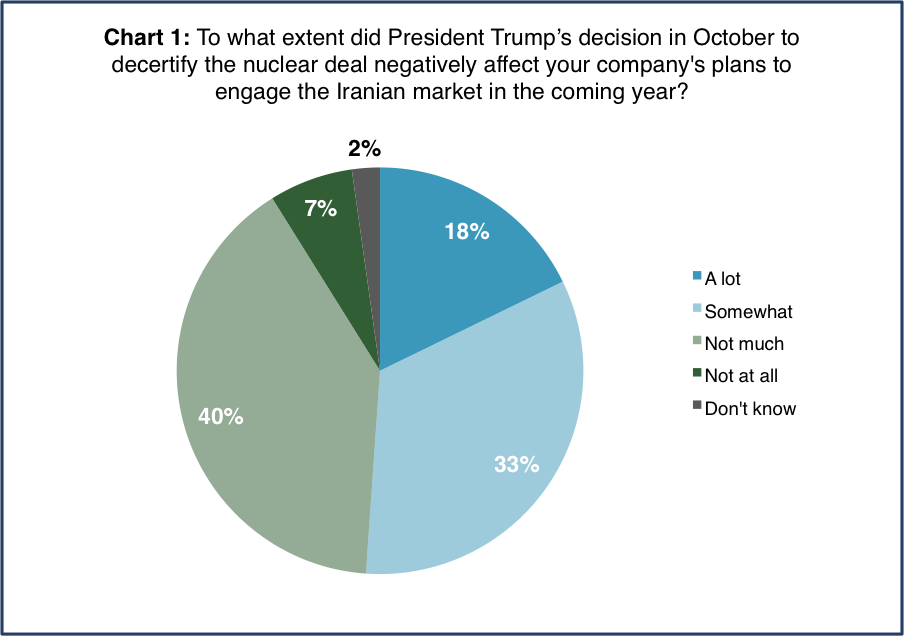

A clear slowdown: Executives clearly believe that there has been a slowdown in Iran business. When asked to evaluate the pace of trade and investment in Iran, 83 percent of senior managers at multinational companies indicate that companies “are moving slower than they could” to engage in the Iranian market. Moreover, 51 percent of executives report that their company’s investment plans were adversely affected by Trump’s October de-certification. The fear of snapback looms large given the reluctance with which waivers are being issued and the tone of today's statements will likely exacerbate these concerns.

External, not internal, barriers: Iran is a difficult place to do business, but senior executives currently see the primary barriers to their commercial plans as external, not internal challenges. When asked what is the “primary obstacle facing your market rollout in Iran,” 32 percent of survey respondents indicate sanctions compliance, while 20 percent point to “managing political and reputational risk.” By comparison, 21 percent point to “access to financing.” These are all external barriers. Domestic commercial and operational issues such as finding a local partner or structuring a local entity are far less frequently identified as major barriers, or as priorities for redress.

Stubborn confidence: Despite all the frustrations, companies remain a source of stubborn optimism and valuable pragmatism on Iran. A majority of executives (63 percent) believe that the Iran Deal is likely to even if the United States pulls out. A staggering 91 percent of executives still believe their company can be commercially successful in Iran. Policymakers, particularly in Europe, need to engage business leaders and support solutions to increase trade and investment. By doing so they can draw upon this increasingly rare confidence to help protect the nuclear deal. The report makes several recommendations about how to do this.

Executive Summary

The story of Iran’s post-sanctions economic recovery is so far one of great expectations and frustrating delays. On the two-year anniversary of the implementation of the Joint Comprehensive Plan of Action, this report examines the “economic implementation” of the nuclear deal. Multinational companies remain committed to the Iranian market, but the much-needed flow of external finance, including foreign direct investment, has yet to materialize. The provision of external finance has been hampered primarily by external factors, and not challenges endemic to Iran’s business environment.

Drawing on a unique survey commissioned by International Crisis Group, including over sixty senior executives, this report details how the risk of sanctions snapback and rising political tension, largely amplified by the rhetoric of the Trump administration, have caused material delays in the Iran investment plans of some of the world’s largest companies. Executives clearly believe that there has been a slowdown in Iran business. When asked to evaluate the pace of trade and investment in Iran, 83 percent of senior managers at multinational companies indicate that companies “are moving slower than they could” to engage in the Iranian market. While Trump has this week opted to reissue the sanctions waivers that keep the United States in the nuclear deal, the act of decertification alone has already compounded delays—51 percent of executives report that their company’s investment plans were adversely affected by Trump’s October announcement.

Against this backdrop, the nuclear deal is sliding into “zombie state.” Neither totally dead, nor totally alive, the deal exists in an ambiguous position that stymies most commercial actors. To address chronic uncertainty, European stakeholders ought to spearhead a technical, programmatic dialogue on the obstacles preventing external finance flows to Iran. In doing so, business leaders will be better positioned to bring their stubborn optimism and valuable pragmatism to bear in support of the quid-pro-quo that underpins the nuclear deal.

This rare optimism should not be taken for granted—a staggering 91 percent of executives surveyed for this report still believe that their companies can be commercially successful in Iran. Given the recent protests in the country, which have made the political imperatives of job creation and economic reform absolutely clear, policymakers should extend every effort to support the success of these companies, whose investments were expected by Iranians as a central outcome of the nuclear deal.

Experts Survey on Business Confidence (Oct. 2017)

A survey taken among a sample of business, government, and civil society leaders reveals that most respondents anticipate the United States to re-impose the sanctions that were lifted under the nuclear agreement (JCPOA). Also, a majority of both Iranian and non-Iranian expert respondents agree that if the sanctions are re-imposed, European companies would become averse to trading and investing in Iran.

A survey taken among a sample of business, government, and civil society leaders, most of whom attended the 4th annual Europe -Iran Forum in Zurich, Switzerland, reveals that most of the respondents anticipate the United States to re-impose the sanctions that were lifted under the nuclear agreement (JCPOA), if Iran refuses to agree to President Trump’s demands. Also, a majority of both Iranian and non-Iranian expert respondents agree that if the sanctions are re-imposed, European companies would become averse to trading and investing in Iran.

This survey which was conducted by IranPoll in partnership with Bourse & Bazaar also shows that overwhelming majorities of both Iranian and non-Iranian expert respondents agree with the dominant view among the Iranian public that multinational companies are moving slower than they could to trade and invest in Iran primarily out of their fear of the United States. Also, while majorities of both Iranian and non-Iranian expert respondents voice confidence that Iran as well as Europe will live up to their obligations under the deal, most say that they do not have such a confidence in the United States.

On another topic, while both Iranian and non-Iranian expert respondents say that Iran’s political system is very or somewhat stable, most do not regard Iran’s economy to be globally competitive.

Main Findings:

The results of this survey were presented at the 4th Europe-Iran Forum. The findings are summarized in detail here.

Survey on Iranian Economic Attitudes (Sept. 2017)

Large majorities of Iranians say growing trade and business tides between Iran and other countries is mostly beneficial for Iran and believe that Iran would mostly benefit from allowing multinational companies to freely compete with Iranian companies. Large majorities also think that Iran should make it easier for multinational companies to operate inside Iran.

Large majorities of Iranians say growing trade and business tides between Iran and other countries is mostly beneficial for Iran and believe that Iran would mostly benefit from allowing multinational companies to freely compete with Iranian companies. Large majorities also think that Iran should make it easier for multinational companies to operate inside Iran.

Multinational companies, however, face many challenges in Iran. A majority of Iranians think that the government should maintain tariffs that protect Iranian industries. As long as such tariffs are maintained, it is going to be unlikely for the multinational companies to be able to compete with Iranian companies on price.

Also, most Iranian households use consumer products that are produced in Iran and multinational companies will have to work extra hard to convince Iranians to switch. This is going to be particularly challenging considering the fact that Iranians consider most products that are sold in Iran as European-made to be counterfeits.

Another important challenge multinational companies face is a perception among Iranians that multinational companies do not take the interests of the Iranian people into account and are no well acquainted with the needs and tastes of the Iranian people. To overcome this challenge, multinational companies need to consider and study the needs and tastes of their Iranian consumers.

Finally, while Iranians continue to support the JCPOA and have confidence that Europeans will live up to their obligations under the agreement, an increasing majority indicate that they are not confident that the United States will live up to its end of the bargain. Iranians also say that multinational companies have moved slower than they could to invest in Iran primarily out of their fear of the United States.

The survey was conducted in partnership with Bourse&Bazaar among a representative urban sample of 700 Iranians. The margin of error for this study was +/-3.7. The fieldwork for this conducted in August 2017.

Main Findings:

The results of this survey were presented at the 4th annual Europe – Iran Forum. The forum agenda is available here.

The detailed full results of the survey are available here. The PowerPoint slides presented in the forum are available here.